News

Global trade increases significantly

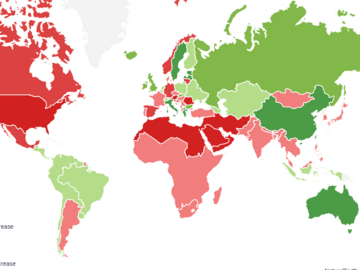

The latest data update of the Kiel Trade Indicator shows a significant increase of 2 percent in global trade in October compared to the previous month of September (price and seasonally adjusted).

This is particularly supported by EU trade, where both exports (+2.5 percent) and imports (+2.4 percent) are clearly up.

For Germany, the October figures for exports (+1.8 percent) are also in the green, but for imports (-0.2 percent) they show a sideways trend. The latest official statistics had just reported a decline in exports for September.

"The global trade figures are stronger than they have been in a long time. Only in March of this year, did we see comparable growth," says Vincent Stamer, head of the Kiel Trade Indicator.

"It is quite surprising that the good figures are being driven by EU trade, where economic output has been shrinking recently. According to the indicator values, the EU’s five largest economies—Germany, France, Italy, Spain, and the Netherlands–were able to increase their exports in October, which is a very positive sign at the start of the fourth quarter."

In the US, exports (+0.2 percent) are likely to remain at the previous month's level according to the Kiel Trade Indicator figures, while imports (+2.1 percent) are expected to rise.

China's trade is apparently following the economic downturn around the globe, with the indicator showing a decline in exports (-1.4 percent) and imports (-1.2 percent). "China's exports developed slightly positively in August and September. However, October shows that a return to previous expansionary phases is proving difficult," says Stamer.

Smooth operation in the container ship network

Although the level of water in the Panama Canal continues to fall, the situation does not pose a major problem for global container shipping. The majority of the approximately 110 freight ships, that anchor on both sides of the canal in total, are tankers and bulkers. The figure of waiting ships has even decreased slightly in the past months. Due to the low water level, the canal authority has further reduced the number of daily cargo ship passages to 25, which would be around 50 percent more at full capacity.

Other major maritime regions are no longer experiencing significant restrictions due to vessel congestion. The ports of Shanghai and Zhejiang are an exception, but wide seasonal swings are common in this region. The volume of standard containers shipped globally underlines the fact that the container shipping network is currently running smoothly. The volume had risen sharply in September and remained above 14 million units in October, close to the peak of two years ago.

"On the container shipping side, nothing stands in the way of a good Christmas business this year. The limiting factor is likely to be the rather gloomy economic outlook and continuing inflation," says Stamer.

For more information on the Kiel Trade Indicator and forecasts for 75 countries and regions, visit www.ifw-kiel.de/tradeindicator.

The next update of the Kiel Trade Indicator will take place on December 6 for November trade data.

About the Kiel Trade Indicator

The Kiel Trade Indicator estimates trade flows (imports and exports) of 75 countries and regions worldwide, the EU and world trade as a whole. Specifically, the estimates cover over 50 individual countries as well as regions such as the EU, sub-Saharan Africa, North Africa, the Middle East or emerging Asia. It is based on the evaluation of ship movement data in real time. An algorithm programmed at the Kiel Institute uses artificial intelligence to analyze the data and translates the ship movements into price and seasonally adjusted growth figures compared with the previous month.

We update the data once a month around the 5th and then present the latest calculations for trade in the current and the previous month.

Arriving and departing ships are recorded for 500 ports worldwide. In addition, ship movements in 100 maritime regions are analyzed and the effective utilization of container ships is derived from draught information. Country-port correlations can be used to generate forecasts, even for countries without their own deep-sea ports.

Compared to previous leading trade indicators, the Kiel Trade Indicator is available much earlier, is much more comprehensive, relies on a uniquely large database using big data, and has a low statistical error by comparison. The algorithm of the Kiel Trade Indicator uses machine learning, so that the quality of the forecast continues to improve over time.