News

Kiel Institute spring forecast: recovery delayed

"A whole range of factors are currently weighing on sentiment and economic data in the German economy. Exports are suffering from a weak global economy, the European Central Bank's monetary policy is restrictive and is likely to remain so into next year, and the German government's austerity measures come at an unfavorable time and are exuding additional pessimism," said Moritz Schularick, President of the Kiel Institute, on the occasion of the economic forecasts published today ("German Economy in Spring 2024: Recovery with obstacles", "World Economy in Spring 2024: Momentum remains subdued").

Following a significant decline in economic output in the final quarter of 2023, the Kiel Institute is forecasting another slim drop in the first quarter. A moderate recovery is expected to set in not before the end of spring. However, economic output in 2025 will only be 2 percent above the level reached before the outbreak of the covid pandemic six years ago.

"Although the German economy is regaining momentum over the course of the year, the overall dynamism remains weak. There are increasing signs that structural problems are primarily weighing on the economy. Private investment lags behind, also because economic policy provokes significant uncertainty," said Stefan Kooths, Head of Economic Research at the Kiel Institute.

In addition, the Kiel Institute now sees corporate investment significantly weaker. Investments in equipment are likely to fall by 1.3 percent in the current year. Construction remains under pressure, with residential construction shrinking even more than in the previous two years by 4 percent. A moderate recovery is expected for next year only.

Positive signals: declining inflation rate, robust labor market

The recovery is being driven primarily by a gradual upturn in private consumption and a gradual increase in foreign business. However, the driving forces—rising mass purchasing power in Germany thanks to higher wages while inflation falls and rising foreign demand—are weaker or are starting later than previously expected.

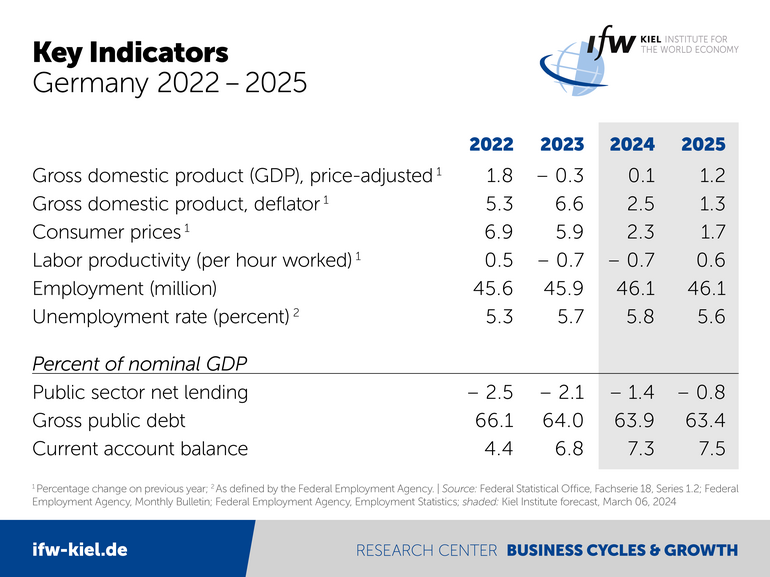

Inflation is declining: after 8.2 percent in the first quarter of 2023, it has already fallen to 2.9 percent and 2.5 percent in January and February respectively. For the current year, the Kiel Institute is forecasting an inflation rate of 2.3 percent, with a further decline to 1.7 percent expected for 2025.

After three years of consecutive declines, real disposable income will increase by around 1 percent in 2024 and 2025.

The labor market remains robust in view of the weak economic environment, with the unemployment rate likely to be 5.8 percent (2024) and 5.6 percent (2025). The number of persons employed will reach a record 46.1 million in the current year, before turning into a downward trend as a result of demographic change.

The fiscal deficit is declining, primarily due to consolidation measures, and is expected to fall from 2.1 percent (in relation to GDP) in 2023 to 0.8 percent in 2025.

After five quarters in reverse gear, exports are gradually picking up again from spring onwards. However, due to the weak winter half-year, exports are likely to fall significantly by another 1.7 percent on average this year, with growth of 2.8 percent expected for 2025.

The not very dynamic but all-in-all stable global economy is expected to be driven somewhat more by industrial production again. As a result, global trade is overcoming its very weak phase and supporting German manufacturers.

Traffic disruptions in the Red Sea is expected not leave major scars in German foreign trade (read more: Freight Volume in the Red Sea Continues to Decline, Fewer Ships in Hamburg).

US presidential election risk

According to the forecast, global production will only increase moderately by 2.8 percent (2024) and 3.1 percent (2025). Not least China's structural problems are preventing stronger growth. The Chinese economy is likely to grow at rates below 5 percent this year and next. The driving force is India, with rates of just under 7 percent.

The US economy is the strongest in the developed economies. In 2024, economic output is likely to increase by more than 2 percent, with momentum slowing somewhat in 2025.

"The presidential election in the US is a major source of uncertainty for the global economy and the prospects for the German economy in particular. If Donald Trump wins the race, new trade conflicts as a result of protectionist initiatives threaten to impair the recovery of global trade. These risks are offset by only very limited opportunities for trade facilitation, for example through new free trade agreements," Kooths said.