News

Kiel Institute Summer Forecast: Some Light at the End of the Recession Tunnel

"There is light at the end of the recession tunnel. There are increasing signs that the German economy leaves the economic slump behind. The interest rate turnaround heralded by the European Central Bank (ECB) is an important step in this direction," says Moritz Schularick, President of the Kiel Institute.

In June, the ECB lowered its key interest rates by 0.25 percentage points—two further rate cuts of 0.25 percentage points each are expected in the course of the year. The rate cuts are improving financing conditions for both companies and consumers, which means that the restrictive effect of monetary policy is diminishing.

"The picture of a sluggish recovery is taking shape. After exports, domestic consumption is about to pick up as the year progresses. However, business investment and residential construction remain weak for the time being. Overall, the nascent upswing is gaining little momentum, like a soccer team struggling to advance after a long defensive battle," says Stefan Kooths, Head of Forecasting at the Kiel Institute.

- German Economy in Summer 2024: Recovery gets off to a slow start

- World Economy in Summer 2024: Moderate growth while cycles converge

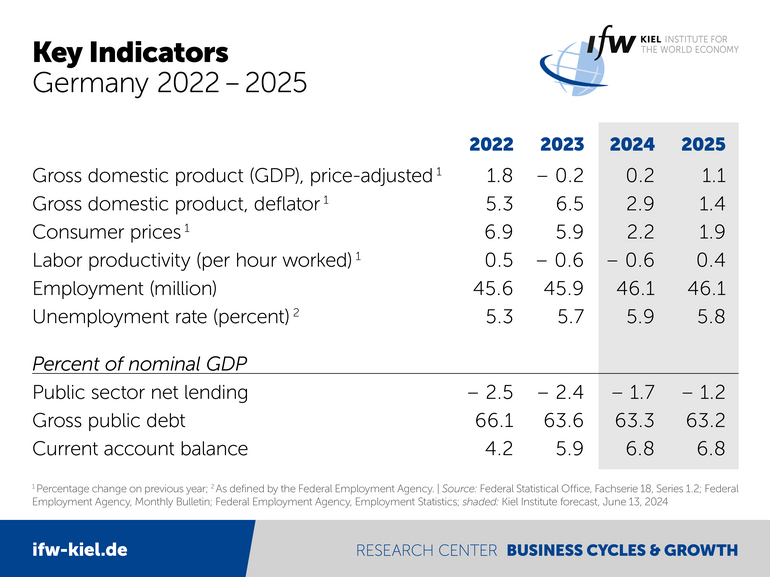

Annual q4-on-q4 GDP growth rates are more indicative of the economic momentum, with values of 1 percent (2024) and 1.2 percent (2025). With annual potential growth estimated below 0.5 percent, overall economic capacity utilization will increase, thus overcoming the recession and reflecting a moderate recovery.

Moderate, but more balanced global economic growth

German exports are expected to remain on an upward trajectory, given the moderate expansion of economic output in customer countries and the recovery in global trade. All in all, exports will increase by 0.6 percent this year and by 2.6 percent in 2025, after declining in 2023.

Overall, the economic divergence among advanced economies is narrowing: While the U.S. economy is gradually slowing, the European economy is picking up noticeably, while the outlook for China has also improved. The moderate expansion of the global economy is likely to continue, with global output expected to grow by 3.2 percent this year and next year. Higher real wages in Europe are stimulating private consumption. The easing of monetary policy will be increasingly felt next year. Geopolitical risks, notably in connection with the U.S. presidential election, could negatively influence global economic activity. An escalation in trade conflicts would also harm the global economy.

High wage growth and robust labor market boost private consumption

After a sharp drop in 2022 and only minor increases last year, real wages are rising by 3.4 percent this year, the highest rate in more than 30 years, lifting real wages slightly above the level of 2019. By and large, employment is expected to move sideways in the coming year, as cyclical upward forces are offset by demographically induced shortages. In the course of the recovery, unemployment will fall from 5.9 percent (2024) to 5.8 percent (2025), compared with 5.7 percent last year. Overall, the development of the labor market will support mass incomes and thus private consumption, which is expected to grow significantly again by 0.6 percent (2024) and 1.2 percent (2025) after a decline of 0.7 percent last year.

Investment remains subdued for now

Construction activity remains weak. The increase in the first quarter was mainly a weather effect. Increased political uncertainty continues to weigh on business investment. In the coming year, investment is only likely to thrive if the business climate for companies improves and construction investment picks up somewhat responding to more favorable financing conditions.

Fiscal consolidation on the revenue side

Over the forecast period, local government expenditure will increase at a much slower pace than recently, but this will be more than offset by additional spending on social security. As a result, despite initial austerity measures, the general government expenditure ratio will continue to rise, reaching 49.5 percent in 2025. Meanwhile, consolidation will take place on the revenue side, with revenues projected to increase by 5.3 percent (2024) and 4.7 percent (2025). As a share of economic output, the government deficit will fall from 2.4 percent last year to 1.7 percent and 1.2 percent in 2024 and 2025 respectively.