News

Kiel Trade Indicator 03/22: World trade in downturn

"The tense situation in the global economy and a volatile container ship network are visible in the Kiel Trade Indicator as almost only negative signs are reported. Real distortions caused by Russia's invasion of Ukraine and the sanctions imposed by the West, as well as a high level of uncertainty among companies with relations to Russia, are noticeably setting back March trade," says Vincent Stamer, head of Kiel Trade Indicator.

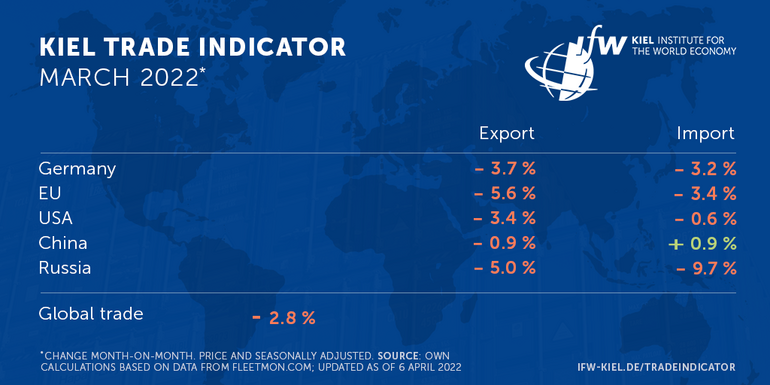

According to the latest data update of the Kiel Trade Indicator for March, world trade is expected to decline by 2.8 percent compared with the previous month (price and seasonally adjusted). The downturn forecasted for February is postponed to March.

For almost all economies, the signs of the Kiel Trade Indicator for March trade are negative. In Germany, exports are expected to fall by 3.7 percent compared with February, and imports by 3.2 percent. Also, for the EU declines in exports (-5.6 percent) and imports (-3.4 percent) are on the horizon. In the U.S.,exports are expected to fall more sharply by -3.4 percent than imports by -0.6 percent.

For Russia, the Kiel Trade Indicator shows a further decline in trade (exports: -5.0 percent; imports: -9.7 percent). At Russia's three largest ports, St. Petersburg, Vladivostok, and Novorossiysk, container freight traffic has already slumped by half.

"The sanctions imposed by the West are clearly having an effect, and the Russian population is facing an increasingly scarce supply of goods from abroad. Europe's companies and shipping lines are obviously restricting transport by sea. The same is likely true for trade via the more important road transport, which explains the sharp decline in Russia's imports," Stamer said.

Ukraine is practically cut off from international maritime trade. No large container ship has called at the country's most important port, Odessa on the Black Sea, since the outbreak of war.

For China, the signals point to stagnation, with black zero for imports (+0.9 percent) and red zero for exports (-0.9 percent). "The lockdown of the Shanghai metropolitan region, where mainly electronic goods are produced for export, is not yet clearly reflected in the trade figures for March. Probably also because the port there continues to operate," Stamer says.

"Future disruptions in China's trade are by no means off the table, however, partly because the Omikron variant of the COVID-19 virus is still rampant. Of concern is the significant increase in global container ship congestion, which can also be attributed to lockdowns in China."

Currently, about 12 percent of all goods shipped worldwide are stuck—last year, the figure was higher in only two months.

For more information on the Kiel Trade Indicator and forecasts for 75 countries and regions, visit www.ifw-kiel.de/tradeindicator.

The next Kiel Trade Indicator updates will be on April 20 (without media information) and May 5 (with media information for April 2022 trade data).

About the Kiel Trade Indicator

The Kiel Trade Indicator estimates trade flows (imports and exports) of 75 countries and regions worldwide, the EU and world trade as a whole. Specifically, the estimates cover over 50 individual countries as well as regions such as the EU, sub-Saharan Africa, North Africa, the Middle East or emerging Asia. It is based on the evaluation of ship movement data in real time. An algorithm programmed at the Kiel Institute uses artificial intelligence to analyze the data and translates the ship movements into real, seasonally adjusted growth figures compared with the previous month.

We update the data twice a month. Around the 20th (without press release) for the current and the following month and around the 5th (with press release) for the previous and the current month.

Arriving and departing ships are recorded for 500 ports worldwide. In addition, ship movements in 100 maritime regions are analyzed and the effective utilization of container ships is derived from draught information. Country-port correlations can be used to generate forecasts, even for countries without their own deep-sea ports.

Compared to previous leading trade indicators, the Kiel Trade Indicator is available much earlier, is much more comprehensive, relies on a uniquely large database using big data, and has a low statistical error by comparison. The algorithm of the Kiel Trade Indicator uses machine learning, so that the quality of the forecast continues to improve over time.