News

US tariffs imposed have little impact on EU-China trade

"The new US tariffs against China are probably primarily motivated by domestic politics, but the worrying thing is that they could trigger a very unfavorable spiral of reactions and counter-reactions for Germany and the EU," says Julian Hinz, trade researcher at the Kiel Institute, referencing simulation calculations on the subject.

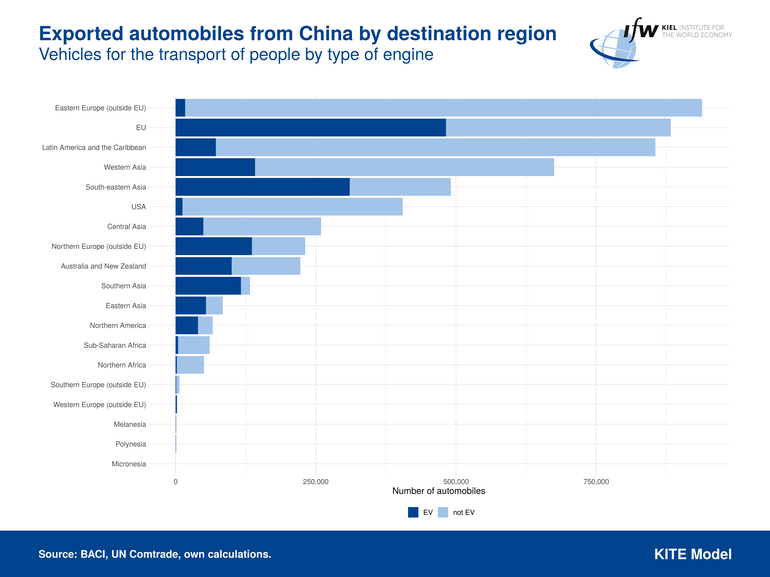

An analysis by the Kiel Institute shows that China sells its electric vehicles (EV) primarily to the EU. In total, almost 500,000 vehicles were sold last year, more than in any other region of the world. That is almost a third of all electric cars exported by China, amounting to around 1.5 million units.

Manufacturers of electric cars in China receive massive state subsidies, with the largest manufacturer BYD alone recently receiving over 2 billion euros per year, as a study by the Kiel Institute has shown.

"The EU is China's most important customer for electric vehicles and has the corresponding negotiating power. The Commission should not stand idly by and watch Beijing's subsidy policy, but it should also not allow itself to be instrumentalized by the US. The Commission should weigh possible tariffs against cheap Chinese electric vehicles for its green transformation, from which Europe has benefited," said Hinz.

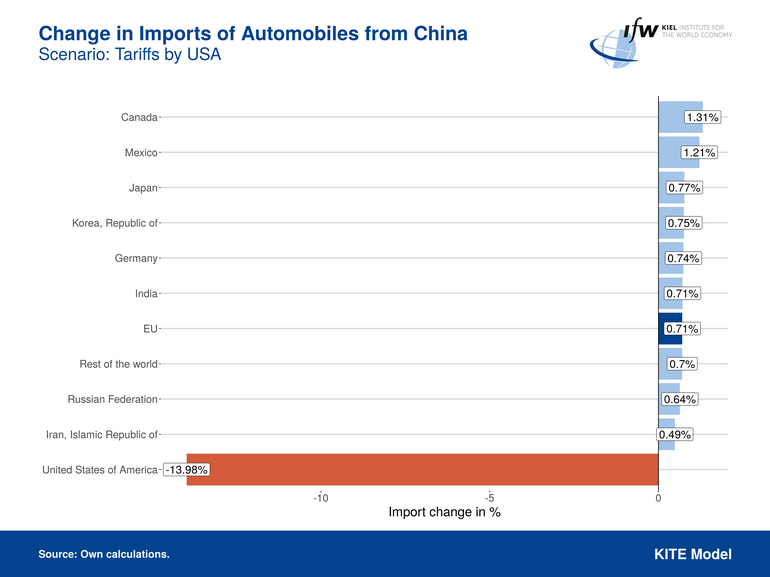

Simulations by the Kiel Institute show that the 100 percent tariffs now imposed by the US on imports of electric cars from China will only cause small shifts in trade, which are hardly significant in absolute terms.

Alternative markets are likely to be Canada and Mexico in particular, with an expected increase in EV imports from China of a good 1 percent. Around 0.7 percent more EVs are likely to be imported into the EU than before. Measured against the total number of 12,000 e-cars imported by the US from China each year to date, the quantities now going to other markets are therefore very small.

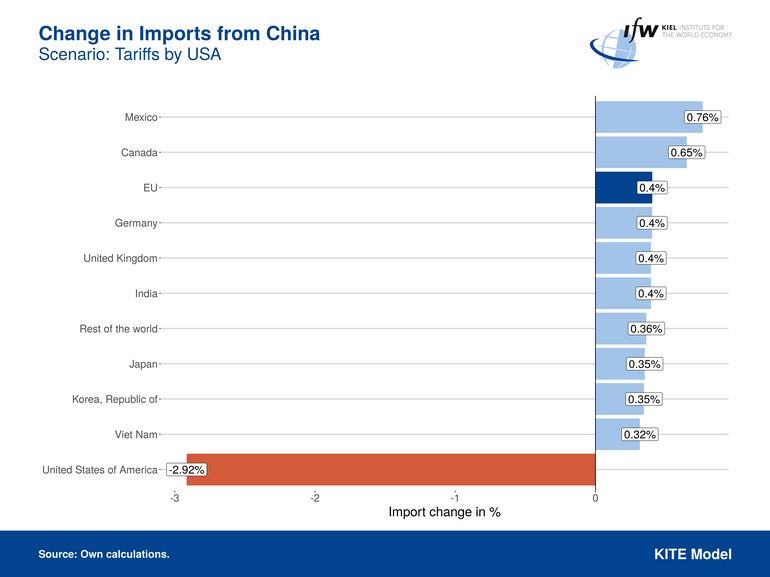

With regards to the overall package of newly imposed tariffs, the simulations show that all US imports from China will fall by as much as 3 percent. The tariffs affect products and industries that have already been subject to tariffs in recent years, the semiconductor sector is particularly relevant.

The tariff measures in themselves have almost no effect on global trade as a whole, as other countries are likely to absorb the loss of US imports. Here too, alternative markets are primarily the US neighbors Canada and Mexico.

The simulation calculations are based on the IfW Kiel Institute's KITE model. The results show the medium to long-term trade effects that arise on a permanent basis. Short-term distortions are not taken into account in the model.