Kiel Trade and Tariffs Monitor

KITE Scenario Analytics

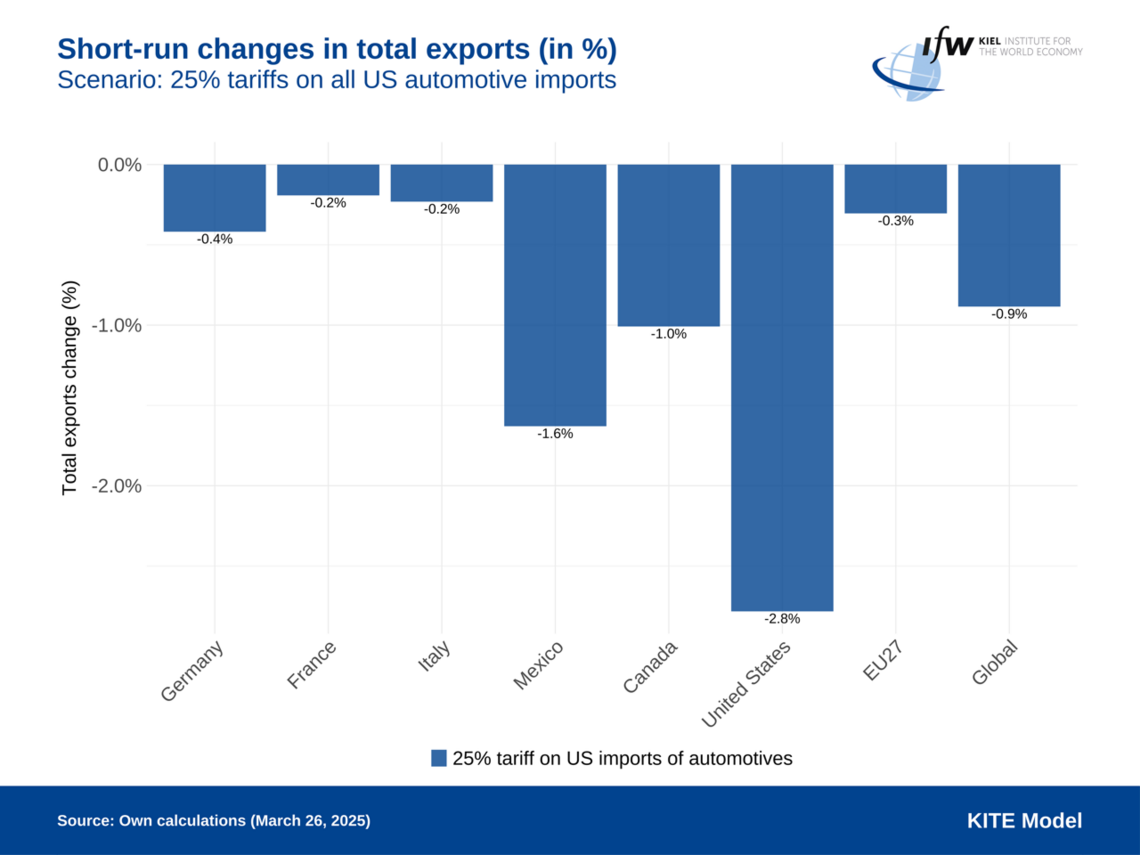

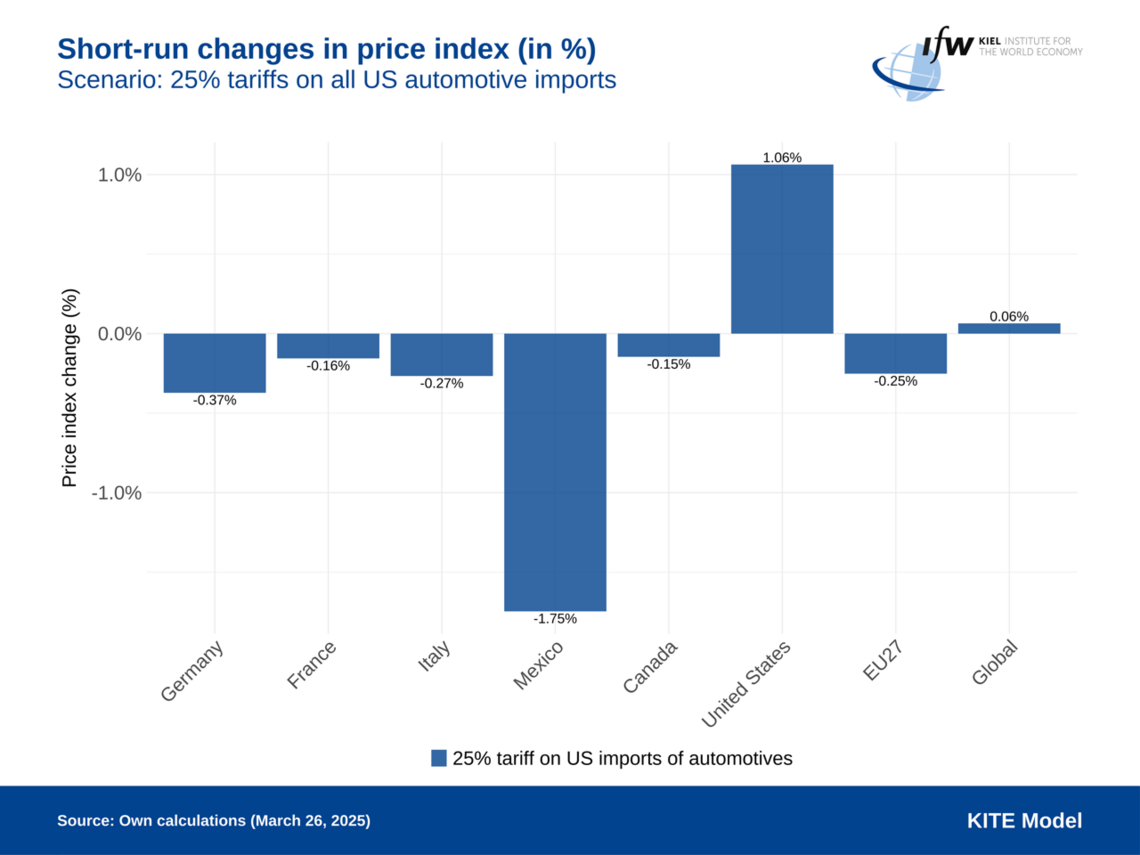

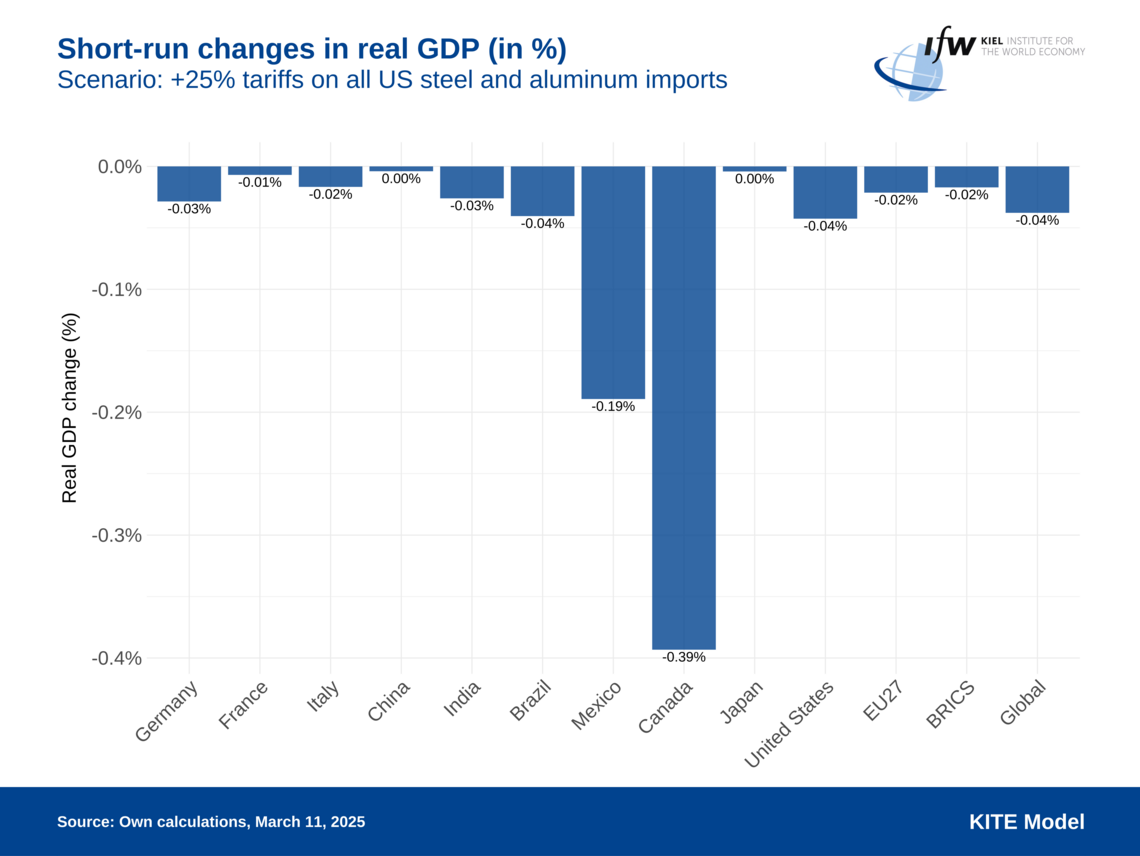

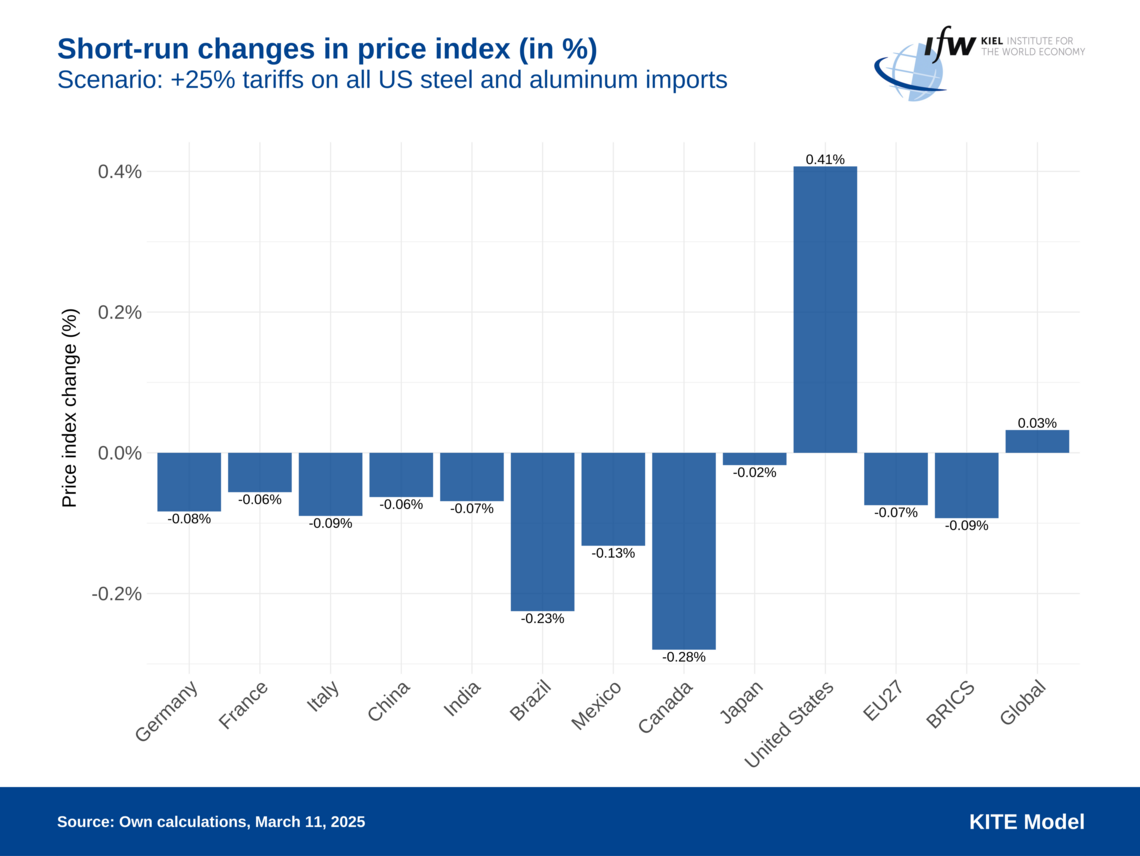

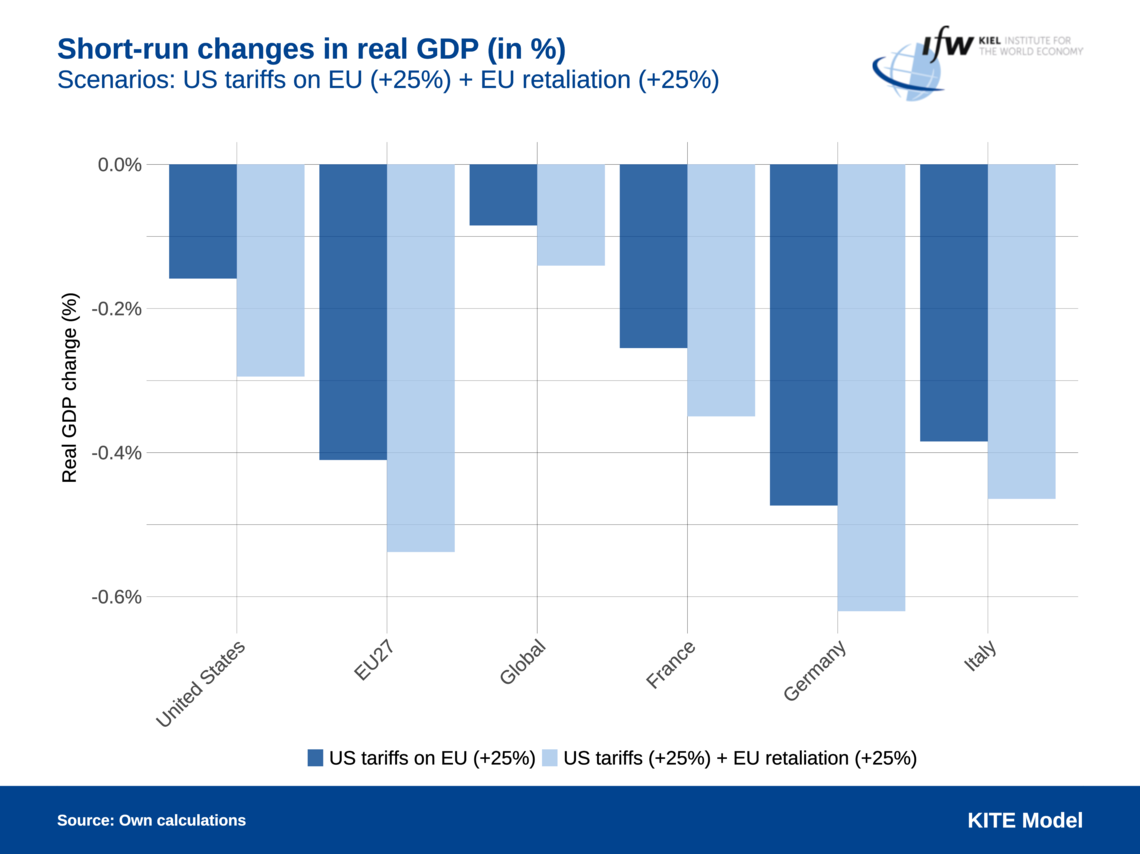

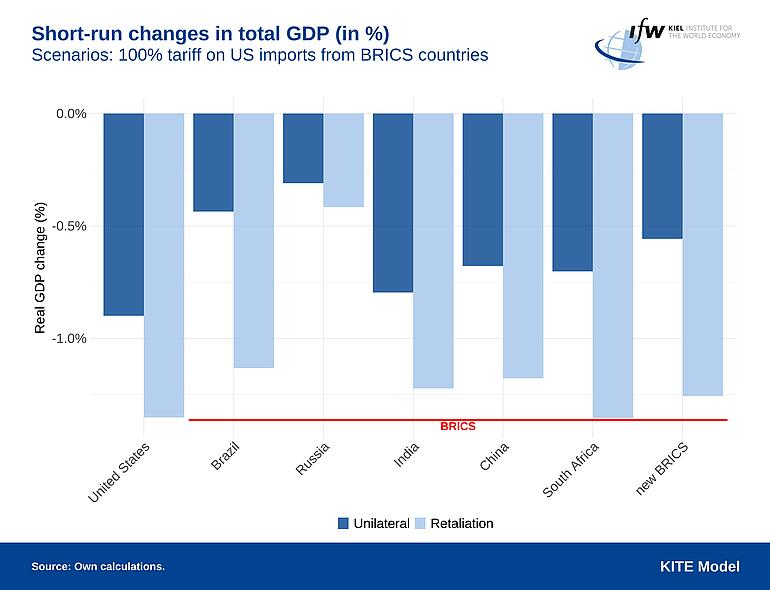

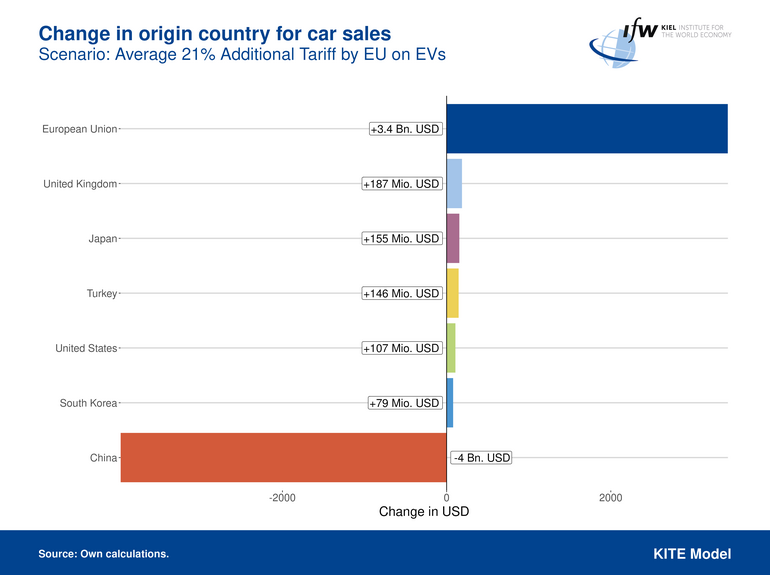

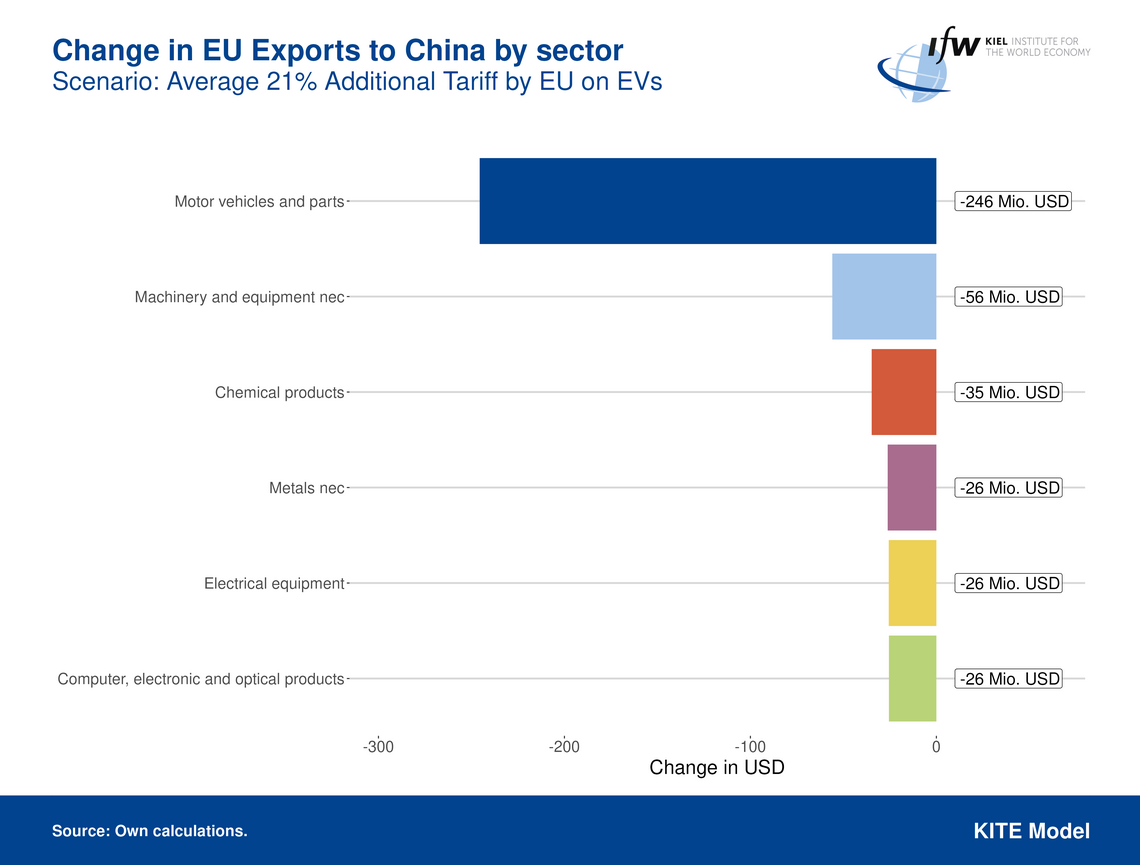

The Kiel Trade and Tariffs Monitor offers in-depth analyses, simulations, and commentaries on the economic impacts of tariffs and trade conflicts. Utilizing the KITE model, the we evaluate scenarios such as the effects of U.S. tariffs on European goods, potential EU countermeasures, and the broader consequences of escalating trade tensions on global economies. To support informed discussions on trade policies, the platform provides access to the raw data used in these analyses, providing structured data of newly announced tariffs. The research is continually updated to reflect current developments, ensuring relevance and accuracy.

More information

News

Tariff Data Download

Access the “tariff deltas,” representing changes in tariffs since January 2025, in CSV format. Detailed information on data structure and sources is available in the accompanying documentation. The files are named "Tariff Deltas [imposing country] - [target country].csv".

Tariff Deltas CAN USA

Tariff Deltas CHN USA

Tariff Deltas USA CAN

Tariff Deltas USA CHN

Tariff Deltas USA erga omnes (EO)

Tariff Deltas USA erga omnes (EO) 02042025

Tariff Deltas EO USA 02042025

Tariff Deltas USA MEX

Tariff Deltas EU USA

Documentation